The Benefits of Timely Reporting Foreign Inheritance to IRS and Its Effect on Your Funds

Prompt coverage of foreign inheritance to the IRS can significantly influence an individual's financial landscape. By recognizing the reporting requirements, one can avoid lawful complications and prospective penalties - penalties for not filing Form 3520. Furthermore, there are tax advantages connected with punctual filing that could boost general monetary planning. The ramifications of these actions can be significant, affecting investment chances and property management techniques. What remains to be discovered are the complexities of global inheritance laws and their effects

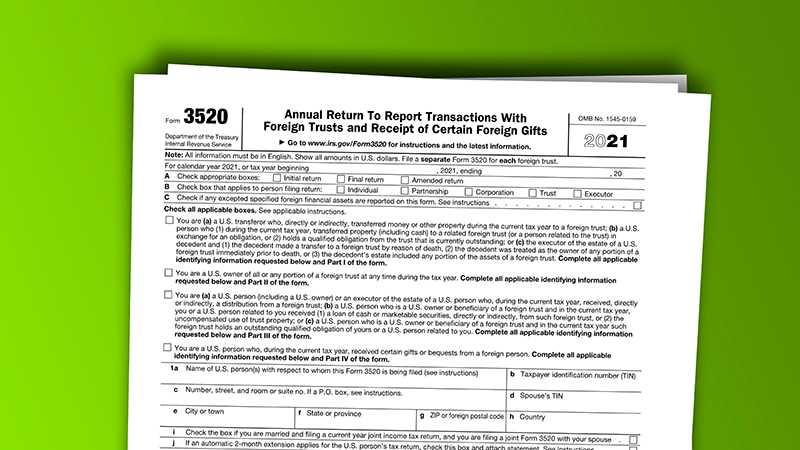

Recognizing IRS Coverage Requirements for Foreign Inheritance

They must navigate particular IRS reporting demands to ensure conformity when individuals receive an inheritance from abroad. The IRS mandates that united state people and locals report foreign inheritances exceeding $100,000 on Type 3520, which is due on the very same date as their earnings tax obligation return. This type captures crucial details regarding the inheritance, consisting of the quantity got and the connection to the decedent. In addition, any kind of foreign savings account connected with the inheritance may call for reporting under the Foreign Financial Institution and Financial Accounts (FBAR) policies if the accumulated worth surpasses $10,000. Comprehending these demands is vital, as failure to report can cause substantial charges. In addition, people must stay conscious of any kind of applicable inheritance tax that may arise from foreign inheritances, particularly if the estate surpasses particular limits. Proper adherence to these standards warranties that people handle their financial obligations properly and stay clear of issues with the IRS.

Staying Clear Of Fines and Legal Issues

Steering through the intricacies of international inheritance coverage can be daunting, but recognizing the demands is important for preventing penalties and lawful concerns. The IRS imposes strict standards on reporting international inheritances, and failure to conform can lead to serious repercussions. Taxpayers must know forms such as the FinCEN Form 114 and IRS Kind 3520, which offer to divulge international presents and inheritances properly.

Disagreement can cause hefty fines, and in many cases, criminal fees might be sought. Additionally, unreported inheritances can complicate estate matters, resulting in more lawful issues. Timely and exact reporting not just reduces these threats however additionally fosters transparency and count on with tax authorities. By focusing on conformity, individuals can concentrate on handling their newfound assets instead than steering possible legal disputes or fines - IRS Form 3520 inheritance. Eventually, understanding coverage demands is crucial for preserving economic comfort

Possible Tax Advantages of Timely Reporting

The key focus of reporting international inheritances often centers on conformity, prompt reporting can likewise disclose prospective tax obligation benefits. By quickly divulging international inheritances to the IRS, people may be able to take benefit of details exemptions and deductions that could decrease their general tax obligation responsibility. The IRS enables particular international estate tax credits that can balance out United state tax responsibilities. Furthermore, prompt reporting may assist in the usage of the yearly present tax obligation exemption, allowing recipients to distribute portions of their inheritance to friend or family without incurring extra tax obligations.

Additionally, early coverage can supply clearness on just how the inheritance fits into a person's general financial image, potentially permitting calculated tax obligation preparation. This positive method minimizes shocks and aids individuals make informed choices concerning their economic future. Eventually, understanding these potential tax obligation benefits can significantly boost the monetary advantages of acquiring foreign assets.

Enhancing Financial Preparation and Investment Opportunities

Timely coverage of foreign inheritances not just ensures compliance with IRS laws however also opens up avenues for boosted monetary planning and financial investment opportunities. They can tactically include these possessions right into their overall economic portfolios when individuals divulge their inheritances discover here quickly. This aggressive method permits for much better analysis of web well worth and facilitates notified decision-making regarding financial investments.

Browsing Complexities of International Inheritance Regulations

Steering through the ins and outs of worldwide inheritance legislations can be tough, as differing lawful frameworks across countries often cause complication and complications. Each territory may impose one-of-a-kind regulations concerning the distribution of properties, tax obligation obligations, and required paperwork, making complex the process for heirs. This complexity is aggravated by the potential for conflicting legislations, particularly when the deceased had possessions in numerous nations.

Regularly Asked Inquiries

What Kinds Are Needed for Coverage Foreign Inheritance to the IRS?

To report international inheritance to the IRS, people normally require to file Kind 3520, which reports international presents and inheritances, and may also require Kind 8938 if foreign assets exceed particular limits.

Exactly How Does Foreign Inheritance Affect My Estate Tax Commitments?

International inheritance may increase estate tax obligation responsibilities depending upon the total worth of the estate and appropriate exemptions. Appropriate reporting guarantees conformity with IRS laws, potentially affecting future tax obligation obligations and estate preparation methods.

Can I Get Foreign Inheritance in Installments?

What Is the Due date for Reporting a Foreign Inheritance?

The deadline for reporting an international inheritance to the IRS is normally April 15 of the following year after receiving the inheritance. Expansions might apply, yet prompt reporting is necessary to stay clear of charges.

Exist Exemptions for Tiny Foreign Inheritances?

Yes, there are exceptions for little international inheritances. Individuals might not need to report inheritances listed below a specific threshold, which varies by jurisdiction. Consulting a tax obligation expert is suggested for certain guidance pertaining to personal scenarios.

.jpg)